$LAVA : A Decentralized Liquidity Distribution Protocol Inside The Molten Ecosystem

The Rise of the Volcano

Two weeks have now passed since Molten erupted onto the scene — starting with a successful stealth launch that saw more than half a million USD in trading volume over the opening day.

With every trade, Molten’s liquidity protocol has been generating and locking ever-increasing amounts of MOL-ETH LP into the Volcano.

As of the time of the writing, Molten has over $92,209 of locked liquidity, the majority of which is locked permanently inside of the contract (our “Volcano”).

Coupled with our deflationary token burn mechanism (10% of supply already burned), Molten has witnessed a rapidly increasing price floor and rapidly expanding community.

However, one point of inefficiency with this protocol is the liquidity pool (LP) tokens are stored centrally within contract, and earned Uniswap trading fees are being wasted.

Thus, we created a new token that can be earned by staking $MOL which solves this inefficiency and aims to decentralize the liquidity among community participants through LP token rewards.

And most importantly, doing so in a way that doesn’t involve any impermanent loss (IL) which is one of the biggest downsides to most yield farming projects.

The Eruption

As you’ve probably noticed, the Molten liquidity Volcano has been steadily rising building up pressure, and now has almost $100k USD of liquidity.

That Volcano is now primed for eruption. Soon, users will be able to stake their $MOL as a tribute to the Volcano.

As a reward for their loyalty, stakers will be rewarded with gifts of a new token with $LAVA .

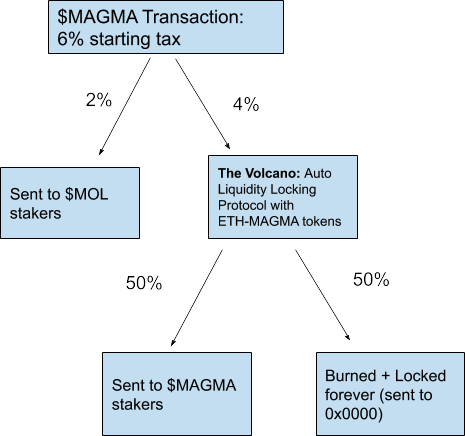

Note: $MAGMA is a work in progress name. We’re not going to reveal the actual token name until the actual launch, to ensure no one falls victim to scammers and/or bots.

Introducing The $LAVA Protocol

$LAVA functions similarly to $MOL in that every transaction will effectively add to the ever-growing liquidity pool, but with a few important distinctions:

50% of the LAVA-ETH LP will be automatically burned. The rest will be distributed to $LAVA stakers.

Like $MOL, 4% of every transaction will go towards liquidity.

However, rather than being perpetually locked inside the protocol as is the case with $LIQ and $MOL, 50% of LAVA-ETH LP generated by the protocol will be distributed to $LAVA stakers.

The other 50% will be locked in liquidity and cast into the fiery depths of the Volcano forever — sent to the burn address

By the way, this is important because the original LIQ protocol (which Molten forked) was broken in that LP tokens stored inside the contract could not actually be burned.

We’ve fixed this issue so the auto-generated LP tokens will be automatically sent to the real burn address (0x00000) rather than being stored inside of the contract.

Stake $LAVA To Earn ETH-LAVA LP Tokens

To receive the LAVA-ETH rewards, you simply need to stake your $LAVA tokens on the staking app.

Rewards will be automatically sent to your wallet in the form of the Uniswap UNI-V2 LP tokens.

You may choose to hodl your ETH-LAVA LP tokens to earn Uniswap trading fees, or un-pool them and receive ETH and $LAVA directly.

The beauty of this model is you will receive ETH (rather than just a single token) and you’ll also have guaranteed liquidity to sell $LAVA into it if you wish.

And being able to do all of this without ever having to create a liquidity pool pair and risk impermanent loss.

Stake $MOLTEN to Earn $LAVA

So how do you get $LAVA?

Well, one way is to buy it directly from Uniswap after the listing.

But as an $MOLTEN holder, you’ll be able to earn $LAVA by staking your $MOLTEN and receiving $LAVA as rewards.

And again, the supply of $LAVA is fixed so there is no inflation and no mint functions.

So then where does the $LAVA come from?

Just like how 1% of every $MOLTEN transaction is burned forever, 2% of every $LAVA transaction is sent to a rewards pool that is distributed to $MOLTEN stakers.

Additionally, a portion of the initial $LAVA supply will be used as bonus staking rewards for the first 7 days for increased APYs to $MOL stakers.

We also note that this dual-staking model will add a further significant deflationary pressure to the circulating supply of both $MOL and $LAVA tokens.

And by the way all the tax rates and percentages are dynamic and adjustable through community voting and DAO (upcoming roadmap feature).

$LAVA Launch Details

Molten had a distinctive fair-launch direct listing with no presale. $LAVA will be no different.

- Again, the team will provide the initial liquidity and lock the majority for 1 year+ and the rest for a shorter time frame so we can reinvest these funds into project developments.

- At listing, each transaction will have a maximum cap of 125 $LAVA per tx (no one can buy more than 3% of the supply in a single transaction)

- Trading of $LAVA will be paused during deployment and only enabled on fair notice to the Molten community

- We’ve already submitted the $LAVA token and staking contracts for a soft audit from the Chief Architect at Swipe. The report will be back by Wednesday and we will fix any bugs or vulnerabilities discovered.

- $LAVA will launch as soon the audit has been completed and the staking UI has been fully tested on test net. We aim for Wednesday November 25th, but it may be pushed back to Monday due to the US Thanksgiving holiday.

We will be running a number of promotional events in anticipation of our $LAVA launch and look forward to welcoming community members old and new as we embark on this next phase of the Molten protocol!

$LAVA TL;DR

- Stake $MOL to earn $LAVA

- Stake $LAVA to earn $LAVA-ETH LP

- Contracts being audited right now

- Launch will likely be Nov 25th or 30th (stay tuned)

Molten Links:

- Website: https://www.molten.finance

- Telegram: https://t.me/moltenfinance

- Twitter: https://twitter.com/moltentoken